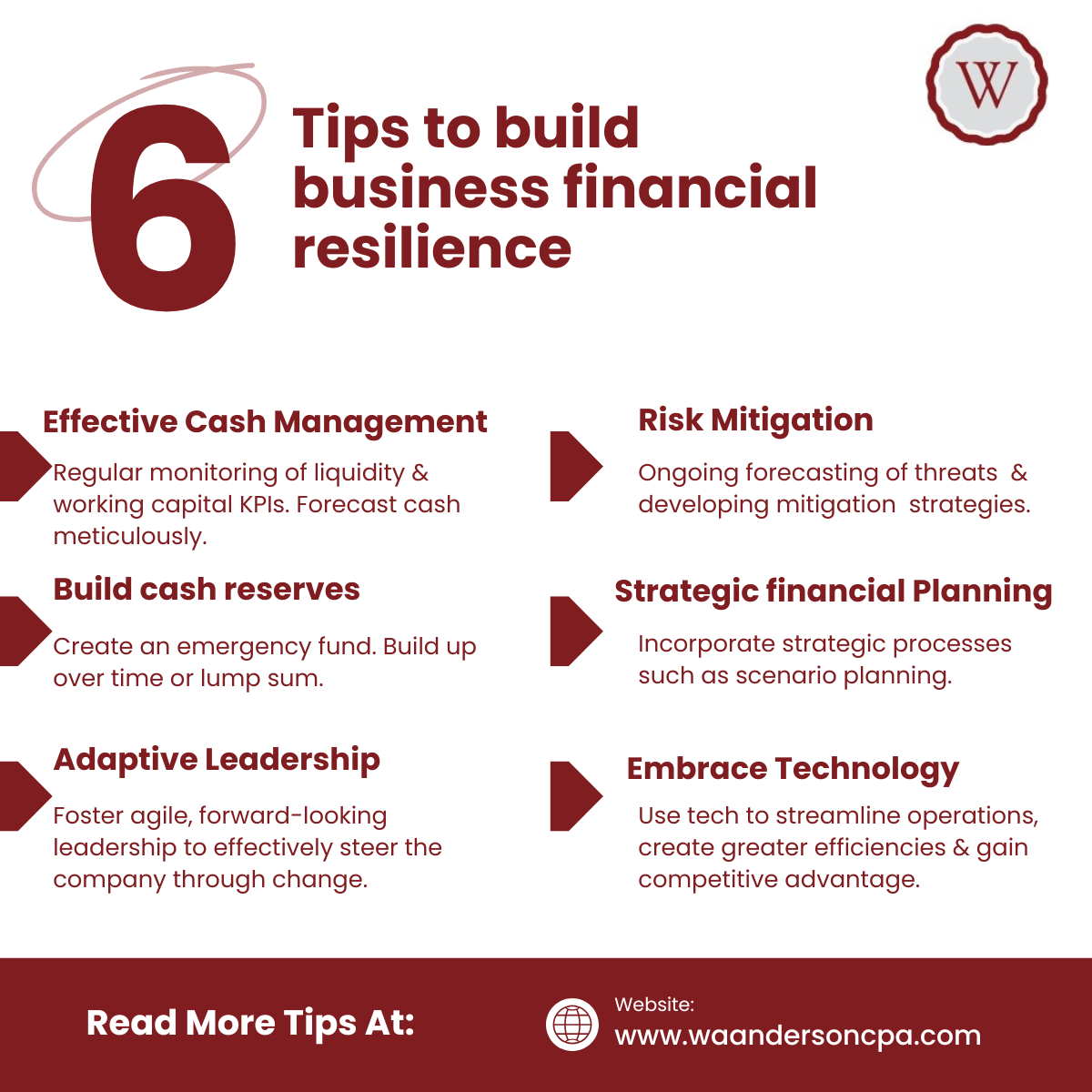

Tips to build business financial resilience

With rising global and domestic economic uncertainties, the need for small & medium-sized businesses to build financial resilience cannot be overstated. It is critical to gaining competitive advantage in the short & long term.

Financial resilience is defined as a company’s ability to withstand shocks, readily adapt to the new realities and continue moving forward with short term stability, while positioning for long term growth. Below are 6 tips to build financial resilience within your organization:

Tips to build business financial resilience

We will now take a deeper dive into each tip mentioned above:

1) Implementation of effective cash management strategies: Including (a) automation of cash management processes to ensure increased efficiency, improved accuracy in cash forecasting , minimized liquidity risk, enhanced cash visibility, better and more timely decision making. (b) routine monitoring of key liquidity and working capital KPIs to ensure these are within the expected range (c) Greater cost control through the cutting of unnecessary costs. A cost that was justified a year ago may no longer be necessary. Also, leadership should create a culture of cost-consciousness throughout the organization.

2) Building cash reserves for future emergencies or unexpected downturns(such as revenue dips). This could be built up over time or on a lump sum basis.

3) Adaptive Leadership: The company should ensure that strong, agile, forward-thinking leaders are in place, who can pivot strategies and effectively lead the company through changes.

4) Risk Mitigation: Businesses must meticulously forecast internal & external threats and determine how best to mitigate them. External risks include supply chain risks and risks from regulatory actions(such as rising tariffs). Internal risks includes non-existent or improperly designed internal controls. These could increase the risk of misappropriation of the company’s assets or create material errors in the financial records. Even the best risk management protocols can’t eliminate all negative outcomes. The company should plan for this as well.

5) Strategic Financial Planning: This includes the development of forward looking financial models such as Scenario Planning. This is a “what-if “ approach, in which a company prepares for uncertainty by planning for multiple scenarios ( best case, worst case and somewhere in between). the company then develop adaptable strategies and actions that can work across the different scenarios.This enables the company to build resilience, as management has proactively developed strategies to operate in different environments.

6) Embrace technology. Use technology to create more accurate financial models, streamline operations, create greater efficiencies, perform repetitive tasks and free up staff to perform more strategic activities.

If you are having anxieties about your organization’s fiscal resilience, you are not alone. Here at WA Anderson CPA we can provide you with expert guidance on how to implement these and other tips to build financial resilience. Contact us today at (813) 489-0295 or info@waandersoncpa.com.

Tips for Effective Business Risk Management

Businesses are constantly facing risks of various kinds. All of which could threaten their existence and ability to achieve their strategic goals. Whether it is cybersecurity risks, reputational risk, supply chain risks or economic environment risks, one thing is certain. All organizations, regardless of size or industry need to implement an effective risk management framework. Below are some key tips for effective risk management.

Fueling business growth with debt

The idea of taking on debt normally carries a negative connotation. However, debt when used wisely can actually propel business growth. Positive cash flow reigns as king but a loan when leveraged wisely is pretty royal. If a bridge loan is used to pay upfront expenses on a large contract, and is paid off upon collection of sales revenue under the contract, this is considered good debt. Similarly, loans that will be invested to generate long term income or value is also good debt. Below are some key ways loans can be used to fuel business growth, providing the rate of return on the investments is higher than the interest rate on the loan :

“Positive cash flow reigns as king but a loan when leveraged wisely is pretty royal”

Investment in Growth: loans can be used to fuel growth if the funds are used to expand the business (hiring new staff, opening new locations or launching new marketing campaigns).

Research & Development: Loans could be leveraged to turn ideas into products, services or market redefinition, all of which could translate to business growth.

Improve Operational Efficiency: Businesses can use debt to invest in upgrading existing equipment and to purchase new technology, both of which could improve efficiency and reduce operational costs. Enhanced efficiency and cost reduction are both drivers of business growth and competitive advantage.

Mergers & Acquisitions: Loans can be used to extend the market share of a company through the acquisition of competitor businesses or the merging of business entities. Both options can fuel business growth in the short and long term.

As shown above, Business Leaders can choose to see debt as an opposing force or when leveraged effectively, as a tool to fuel growth of their organizations. The key to success lies in managing debt wisely. It is important to review loan contracts regularly, refinance high interest loans as soon as possible, use bridge-loans for short term needs and avoid over-leveraging as this could adversely impact cashflows.

Our CFO Advisory service offering includes debt management and cash flow management in general. Feel free to schedule a complimentary consultation below or call us at (813) 489-0295.

10 cash flow missteps your business may be making and how to avoid them

Positive cash flows is the lifeblood of every organization. The definition of a growing and successful business is one that is able to generate net positive cash flows on a consistent basis. Even with the best profit margins, if your company is not generating positive cash flows, that’s a huge red flag. A company that is experiencing cash flow challenges could be making one or more of the following missteps:

Not forecasting regularly- Management should create short term (weekly, monthly) and long term (quarterly, annually) cash flow forecasts. This helps them to proactively identify future cash shortages or surpluses and to plan accordingly. If there are anticipated cash shortages, management may need to consider securing a line of credit or transferring funds from the operating reserves. Alternatively, if a cash surplus is forecasted, funds could be moved to operating reserves via some sort of short term investment such as treasury bills.

Failure to leverage financial metrics & Key Performance Indicators (KPIs): Management should regularly monitor cash flow and liquidity ratios to ensure they remain comparable to industry averages and within the company’s target range. These ratios include the quick ratio, cash conversion cycle, and working capital ratio. Staying on top of these metrics ensures that red flags are identified and addressed before they become much bigger problems.

Not focusing enough on accounts receivable & payables turnover: The goal should always be to increase the accounts receivable turnover rate through such measures as incentivizing early customer payments by offering small discounts, ensuring that invoices are accurate to minimize delays in payment due to inaccuracies and automating invoicing to ensure timely billing. Additionally management should seek to prudently extend payment terms for vendors to delay outgoing cash flow. Management should also consider reviewing vendor payment terms at least annually and seek to renegotiate extended payment terms.

Ineffective debt management: Management should review loan contract terms and consider refinancing high interest loans. Additionally, they should utilize ratio analysis to measure and monitor whether the company is adequately leveraged. In other words not carrying too much debts.

Not performing fixed asset purchase vs lease analysis : Asset leasing results in a much smaller outlay of cash upfront when compared to purchasing. Accordingly, management should consider exploring the leasing option to acquire much needed machinery and equipment for their companies. In this way freeing cash flow to be used for other urgent needs.

Ignoring best practices for cash flow risk management: Management should consider taking out credit insurance to mitigate the risk of material debtor balances defaulting on payment. Additionally, they should implement supply chain diversification to minimize the risks of supplier chain disruptions. Additionally, management should consider creating an operating cash reserve to minimize disruptions from future uncertainties.

Ignoring the implementation of robust internal controls surrounding cash management: Management should implement robust internal controls to safeguard safeguard cash. For eg. the use of Positive Pay to prevent the cashing of unauthorized checks. Additionally, there should be proper segregation of duties surrounding the cash function and proper review and approval of vendor invoices.

Failure to perform regular profitability reviews: Management should perform regular profitability reviews of all areas of the business(including product/service line, locations and customer segments). They should consider eliminating or revamping low profit-margin segments, products/service lines, while ensuring the most profitable activities are adequately funded.

Not conducting Scenario Planning: Management should leverage scenario planning (through financial modeling) to assess the cash flow implications of changes in certain key variables. For eg. hiring additional staffing, increased raw material costs or a significant decline in revenues. This allows management to proactively plan for cash shortages and ensure adequate liquidity on a consistent basis.

Not fostering a culture of cash flow optimization: Management should create a culture that encourages or rewards employees who seek to optimize cash flow. They should provide tools and training to foster a mindset of continuous improvement to the organization’s cash flow position.

As part of our CFO advisory Service offering, we assist small businesses and nonprofits with developing and implementing effective cash flow management strategies. Should you need any assistance in this area, please feel free to book a free consultation below or call (813) 489-0295.

FinCEN Beneficial Ownership Reporting

With less than two months remaining in 2024, it is important that all business owners and leaders are aware of and in compliance with a 2024 federal regulatory update that impacts an estimated 97% of small and medium sized businesses. On January 1, 2024, the Corporate Transparency Act (CTA) was officially enacted into law as part of the National Defense Act. The CTA mandates the disclosure of Beneficial Ownership Information(BOI) to the Financial Crimes Enforcement Network (FinCEN). This new reporting requirement aims to combat money laundering, terrorism financing and other illicit activities, by requiring businesses to report both their ownership and disclose who exert substantial control over their organization.

Which companies must file

In general, most corporations and LLCs registered in the US are required to file unless they fall under a narrow category of exemptions. The exempt filers include publicly traded companies, nonprofits, registered investment entities and managers and other highly regulated entities such as banks and insurers.

BOI reporting deadlines & Penalties

A company formed before 2024: BOI report due by January 1, 2025.

A company formed during 2024: BOI report due within 90 days of formation.

A company formed after January 1, 2025: BOI report is due within 30 days of formation.

Penalties : Non-compliance with this new law attract hefty fines of up to $591 per day, with a maximum total of $10,000 per entity

How to file

The Treasury Department of the Government has created a direct filing portal for BOI reporting Link to Portal . To assist with filing, the government has provided a 21-page instruction manual, accompanied by a 50-page small entity compliance guide.

Recent filing extensions granted by the Government

On 10/29/2024, FinCEN announced that certain victims of Hurricanes Beryl, Debby, Francine, Helene and Milton will receive an additional six months to submit beneficial ownership information (BOI) reports. See each of the notices from FinCEN below:

Hurricane Beryl

6 Tips for growing business cashflows

Cash to a business is what oxygen is to humans…life! The old adage “cash is king” is indeed true. Without sufficient cash, businesses are unable to meet their commitments as they become due (salary, rent and loan payments, to name a few). Research shows that 50% of small businesses fail by their 5th birthday due to an inability to generate consistent, positive cashflow. In most cases. these business owners do not have the inhouse expertise to help them implement successful cashflow management strategies.

Below are 6 tips to consider implementing to improve your business cash flow position:

Prepare accurate Cashflow Forecasting- Many business owners plan for various future initiatives including preparing sales projections, however they often fail to prepare cash flow projections. These projections are equally as important as all the other company wide projections. Cash flow projections indicate when future shortfall in cashflow may occur, or where there may be future cash surplus. This allows business owners to proactively plan for these cash events. For example, projected cash shortfalls can be addressed by taking out a bridge loan or line of credit or a draw down of cash reserves. On the other hand when a cash surplus is projected, arrangements can be made to move the excess funds into cash reserves. This may take the form of a short term interest earning CD or a separate interest earning savings account.

Reduce outstanding accounts receivable days/increase accounts payable days- In order to improve cash flows, the goal should always be to shorten the required payment terms for your customers as short as possible, whilst negotiating the longest payment terms possible with vendors. Under no situation should your organization be paying your vendors quicker than you are collecting accounts receivable balances. This is a recipe for creating cash deficiency. Customer collections can be improved by offering discounts to incentivize faster payments, requesting deposits on large, lengthy contracts and utilizing mobile payment solutions to get paid quickly.

Reduce inventory days & eliminate obsolete inventory- Excessive inventory purchases is one of the biggest mistakes that small businesses across all industries make. This has a negative impact on cashflow. Businesses should strive to balance reducing inventory purchase sand having a suitable level of inventories to enable them to operate normally. Where possible, business owners should consider investing in a Just-in-Time inventory management system to minimize cash tied up in inventories. Additionally, ongoing inventory monitoring should identify existing obsolete inventory. These should be sold off as soon as possible to provide an infusion of cash.

Maintain operating reserves - Many businesses experience peaks and valleys in financial performance, depending on customer demand for their products or services. Any surplus cashflows realized during peak performance should ideally be set aside in an interest earning reserve account. These reserves can provide your organization with ready access to cashflows when there is a slow down in business and resulting reduction in available cashflow.

Activate a bridge loan or line of credit- Cash is king, however, a bridge loan or line of credit can prove to be pretty royal as well. This facility should be used used to address cash flow shortfalls until significant accounts receivable balances are collected. For eg. a company signs a large contract with the federal government, which requires significant investment in new staffing or capital purchases. The business cold access its bridge loan or line of credit facility to make the necessary purchases required under the contract. The facility would be paid down once payments have been received under the contract. The loan facility should never be used to make payments, with no defined strategy to pay it down.

Effectively manage operating & capital purchases- Start up and emerging businesses that have not yet attained a break even position, should pay closer attention to capital purchases than more mature companies. Depending on the nature of the business and the stage of growth, leasing of capital assets may be a better cashflow solution than purchasing. A cashflow and cost analysis of purchasing versus leasing should be performed in order to make the correct decision. Another significant business expense which ties up significant cashflows is salaries and wages. Smart hiring is critical. Business owners should consider whether it is a better cash flow option to outsource certain positions. Again, a detailed cashflow and cost analysis of both options is recommended.

The ability to generate consistent positive cashflows is a crucial component of any successful business. Our firm partners with small and emerging businesses to help them achieve optimal cashflows. Give us a call today at (813) 489-0295 or email info@waandersoncpa.com.

Which Key Performance Indicators(KPIs) should your Nonprofit be measuring?

KPIs are critical, quantifiable measures of actual performance against strategic goals, over a defined period of time. KPIs are to a Nonprofit leader what the instrument panel is to an Aircraft Pilot. They give advance insight into not only current conditions (eg. direction, speed and altitude)but also future performance ( eg. climbing, descending and estimated time of arrival)of their organization. Nonprofit leaders make their best decisions and their teams achieve their maximum potential by constantly monitoring their KPIs against their goals, and proactively taking corrective actions when required.

Which KPIs should your nonprofit consider prioritizing?

While there are numerous KPIs your nonprofit could be tracking, for the purpose of this article, we will focus on the accountability & finance KPIs tracked by Charity Navigator. Charity Navigator is one of the leading organizations that evaluate the performance of 501(c)(3) in the United States. They analyze performance based on (1)Accountability & Finance, (2)Impact & Result, (3) Culture & Community, and (4)leadership & adaptability. Each charitable organization reviewed is assigned a star rating from 1 to 4, with a 4 rating being the highest rating. Obtaining a 4-star rating from Charity Navigator can boost an organization’s ability to secure donations and grants from donors. The purpose of the star rating is to show donors how efficiently a charity is using their support, how well it is achieving its mission and its commitment to being accountable and transparent. Even though Charity Navigator only evaluates nonprofits with public support greater than $500,000 and total revenues greater than $1 million, nonprofits of any size can use their KPIs to track and manage their organizations successfully and efficiently. It should be noted that a Nonprofit organization must file at least three consecutive years of Form 990 returns with the IRS, in order to receive a score from Charity Navigator.

Charity Navigator Financial KPIs

Average program expense ratio: Nonprofits exist to provide programs and services. They fulfill donor's expectations when they allocate a significant portion of their budget towards their stated missions. Charity Navigator calculates the Nonprofit's average program expense over its 3 most recent fiscal years and then assign a numeric score based on an established scale.

Liabilities to assets ratio: This metric helps donors understand if their donations are primarily being used to service debt and/or other obligations rather than servicing the charitable mission. Charity Navigator calculate a charity's ratio of liabilities to assets by comparing the organization's total liabilities to total assets in the most recent tax year, and then assign a numeric score based on an established scale.

Fundraising efficiency ratio: Financially effective charities should be efficient fundraisers, spending less to raise more. Charity Navigator calculate the charity's average fundraising expenses and total contributions over its 3 most recent fiscal years and then assign a numeric score based on an established scale. It should be noted that this ratio only applies to donor-funded charities with more than $2 million in annual revenue.

Working capital ratio: If a charity has insufficient working capital, it faces the difficult choice of having to eliminate programs and/or staff, take on debts or dissolve operations all together. In contrast, when donations are strong, those charities that build working capital, develop a greater capability for expanding and improving their programs. Charity Navigator analyze a Charity's working capital ratio by determining how long it could sustain its current programs without generating new revenue. They calculate working capital for the most recent tax year, and its average total expenses over its 3 most recent fiscal years. They then calculate the ratio between working capital and average total expense and then assign a numeric score based on an established scale.

Charity Navigator Accountability KPIs

1. Audited Financial Statements/ Audit Oversight Committee: Charities with over $1 million in total revenues are expected to complete an audit. For those with revenue between $500k and $1 million, an audit, review or compilation is expected.. For those with less than $500k in revenue, this metric is not applicable. For larger organizations, Charity Navigator expects them to have an audit oversight committee that is responsible for choosing the independent accountant and overseeing the needed financial documentation. The independent accountant’s audit, review or compilation report should be posted to the Nonprofit’s website.

2. Board Composition: For large donor funded organizations, Charity Navigator verifies that the organization has at least five independent board members, and that those members make up a voting majority. For smaller Nonprofits, a minimum of three board members is required and more than 50% of those members should be identified as independent on Form 990.

3. Material diversion of assets: any unauthorized conversion or use of the organization’s assets other than for the organization’s authorized purposes, including but not limited to theft or embezzlement, can seriously call into question a charity’s financial integrity. Charity Navigator verifies whether there have been material diversion of assets.

4. IRS Form 990 Listed on the website: Charity Navigator checks to ensure that the Nonprofit has posted its most recently filed IRS Form 990on its website. A direct link from a charity’s website to its Form 990 on an external site is sufficient. As with the audited financial statements, donors need easy access to this financial report to help determine if the organization is managing its resources well.

5. Documents Board Meeting Minutes: An official record of events during a board meeting ensures that a contemporaneous document exists for future reference. Charities are not required to make their board minutes available to the public. For this metric, Charity Navigator verifies that the organization reports on its Form 990 that it retains those minutes.

6. Whistleblower Policy: This policy outlines procedures for handling employee complaints and provides a confidential way for employees to report any financial mismanagement. Again, Charity Navigator does not review the actual policy, they verify that the Nonprofit indicated the existence of a policy on Form 990.

7. Conflict of Interest Policy: This policy protects the organization and by extension, those it serves, when it is considering entering into a transaction that may benefit the private interest of an officer or director of the organization. Charities are not required to share their conflict of interest policies with the public. Charity Navigator simply verifies that that the charity reports the existence of the policy on its Form 990.

8. Records Retention & Destruction Policy: This policy establishes guidelines for the handling backing up, archiving and destruction of documents. This fosters good record keeping procedures that promote data integrity. Charity Navigator does not review the actual policy, they verify that the Nonprofit indicated the existence of a policy on Form 990.

9. Website listed on Form 990: Nonprofits should have an online presence so that the public can easily find information about their programs, activities and leadership.

10. Loan(s) to and from Related Parties: Making loans to related parties, such as key officers, staff or Board members is not standard practice, as it diverts funds away from the Charity’s mission and can lead to real and perceived conflict of interest problems. The IRS requires charities to disclose on their Form 990 any loans to or from current and former officers, directors trustees, key employees and other “disqualified persons” Some state laws actually prohibit loans to board members and officers. Loans to the Nonprofit from employees and trustees is also not encouraged as these could also lead to real or perceived conflict of interest. Furthermore, it suggests that the organization may be financially unstable. Charity Navigator verifies whether there have been loans to and from related parties. (It should be noted that this KPI applies to donor-funded charities with $2 million or more in annual revenue)

11. Provided copy of Form 990 to the Governing Body ahead of filing: This is considered a best practice as it allows for thorough review by the individuals charged with overseeing the organization. The Form 990 ask the charity to disclose whether it has followed this best practice. (It should be noted that this KPI applies to donor-funded charities with $2 million or more in annual revenue)

12. Donor Privacy Policy: Charity Navigator verifies whether the Nonprofits website has a donor privacy policy and it its contents are sufficient to protect the donor’s information. (It should be noted that this KPI applies to donor-funded charities with $50 million or more in annual revenue)

13. Board members listed on the website: Publishing this information enables donors and other stakeholders to view the make up of the board of directors. Charity Navigator reviews the Nonprofit’s website to ensure its board members are listed. (It should be noted that this KPI applies to donor-funded charities with $50 million or more in annual revenue)

14. Key staff members listed on the website: While key staff should be reported on the Form 990, the Charity’s staff may have changed since. Charity Navigator verifies that key staff members are listed on the website. (It should be noted that this KPI applies to donor-funded charities with $50 million or more in annual revenue)

15. Process for determining CEO Compensation: The Nonprofit should have a documented policy that it follows each year. The policy should at a minimum indicate that an objective and independent review process has been conducted to determine the CEO’s compensation. This includes benchmarking against comparable organizations. Charity Navigator verifies that this process is documented on the Form 990. (It should be noted that this KPI applies to donor-funded charities with $50 million or more in annual revenue)

16. CEO name & salary listed on Form 990: Charity Navigator verifies that the nonprofit complied with the Form 990 instructions and included this information.(It should be noted that this KPI applies to donor-funded charities with $50 million or more in annual revenue)

17. Board members and compensation status is listed on Form 990: Charity Navigator verifies that all Board Members are listed on the Form 990, with an indication of whether or not they are compensated. No Board Member should be compensated for simply being on the board. (It should be noted that this KPI applies to donor-funded charities with $50 million or more in annual revenue).

Assuming your Nonprofit has strong Charity Navigator ratings on the above mentioned governance and financial KPIs, this can serve to strengthen donor engagement and donations, a goal all Nonprofit organizations strive to attain.

Unlocking your business financial stability- Ratio Analysis

Discover ways to measure your organization’s current year financial performance against industry standards, prior years results, and even your competitors..

Ratio analysis falls under the general umbrella of financial analysis, which is defined as the selection, evaluation and interpretation of financial and other data to assist in the making of informed business decisions. Financial analysis may be used by internal stakeholders such as business owners and department heads to evaluate financial performance of a business division or make decisions on whether to discontinue ineffective programs or strategies. External stakeholders such as banks or prospective investors may use financial analysis to assess creditworthiness of an organization or to make investment decisions.

Ratios can be broken down into two types: effect and causal ratios. Effect ratios show what has happened, in other words, the financial outcome. Causal ratios on the other hand help to identify the underlying cause of the effect ratio. For the purpose of this article, we will be focusing on effect ratios.

Effect ratios can be divided into four categories:

Profitability ratios: measure profitability compared to size, margins and returns. They include:

- Gross profit ratio that measures product mark up. Computed as gross profit ÷ by sales.

- Return on sales measures the net profitability of each dollar of sales. Computed as net income ÷ by sales.

- Return on equity measures the net profitability of each dollar of equity investment. Computed as net income ÷ by equity

Operating ratios: measure an organization’s efficiency. They include:

- Total asset turnover ratio measures the effectiveness of an entity in using its assets during a period of time.Computed as net sales ÷ average total assets- Fixed asset turnover ratio measures the effectiveness of an entity in using fixed assets to generate revenues.

Computed as net sales ÷ total fixed assets

- Days sales Outstanding (DSO) measures the effectiveness of collections. Computed as Average accounts receivable ÷ total credit

sales × 365. It should be noted that average receivables is computed as the average of the beginning and ending receivables for the

the fiscal year.

- Days inventory outstanding (DIO)measures the average number of days it takes an organization to sell its inventory.

Computed as average (or ending ) inventory balance ÷ cost of goods sold × 365

- Days payable outstanding (DPO)measures the average number of days an organization takes to pay its vendors.

Computed as average (or ending) accounts payable × 365 ÷ cost of goods sold .

- Cash Conversion Cycle (CCC) measures the number of days it takes for a company to convert its investment in inventory into cash

flows from sales. It is computed as DSO+ DIO - DPO.

Liquidity ratios : measure how well an entity can pay for its short term obligations. The most frequently calculated liquidity ratios include:

- Current ratio. Computed as current assets ÷ current liabilities

- Quick ratio. Computed as (current assets - inventory) ÷ current liabilities

- Defensive interval ratio calculates how many days a company could continue to pay its normal expenses if it had no new source of

revenues. It’s the conservative measure of financial strength and the ability of the organization to weather a business disaster.

Computed as quick assets ÷ daily cash operating expenses. Quick assets are defined as cash, cash equivalents and marketable

securities that are readily available for sale. Daily cash operating expenses are defined as (annual operating expenses - depreciation

and amortization) ÷ 365.

- Cash flow adequacy ratio- measures the organization’s ability to cover its main cash requirements. Computed as cash from

operations ÷ (long term debt paid + assets acquired + dividends paid)

- Quality of liquidity ratio- measures the concentration of receivables and inventory in working capital. Computed as follows:

Inventory ÷ working capital- measures an organization’s investment in inventory.

Accounts receivable ÷working capital- measures the build up accounts receivable.

4. Leverage ratios : Measure debt usage and ability to afford debt. The most common leverage ratios are as follows:

- Debt to equity ratio computed as total liabilities ÷ total net worth

- Debt to assets ratio computed as total liabilities ÷ total assets

- Shareholder Equity ratio: measures how much of an entity’s assets have been generated by issuing equity shares as opposed

to taking on debt. Computed as Total shareholder equity ÷ total assets

- Times interest earned ratio- measures the ability of an organization to meet interest payments with current profits.

Computed as Earnings before interest and taxes(EBIT) ÷ interest expense

The desired trend directions of common ratios are as follows:

↑ Current ratio

↑ Quick ratio

↑ Defensive interval

↓ Days sales outstanding

↓ Days inventory outstanding

↓ Inventory to working capital

↓ Receivables to working capital

↓ Debt to net worth

↓ Debt to assets

↑ Times interest earned

Combatting Cybersecurity Risks- Phishing

Regardless of the industry your organization operates in, research has shown that since 2019, small business cyber breaches have increased a whopping 424% year over year! 90% of cyber attacks began with a phishing email. Phishing is a cyber attack where attackers disguise themselves as trustworthy entities to deceive individuals into divulging sensitive information, such as login credentials, financial details or personal data. There are various types of Phishing attacks:

Email Phishing: This is the most common form of phishing in which attackers send fraudulent emails that appear to come from legitimate sources, often containing links to fake websites or malicious attachments.

Spear Phishing: Targeted attacks aimed at specific individuals or organizations, where attackers use personalized information to make the phishing attempt more convincing.

Whaling: A form of spear phishing that targets high-profile individuals such as C-suite staff or other key employees within an organization.

Smishing (SMS Phishing): Phishing attacks conducted through text messages, attempting to trick recipients into providing personal information or clicking malicious links.

How to React to Phishing

Phishing emails or texts usually have certain suspicious indicators such as generic greetings, spelling errors, urgent or threatening language, mismatched email addresses, and unexpected attachments or links. Always verify requests for sensitive information or financial transactions through a secondary communication method, such as a phone call to the requester. If you suspect a phishing attempt, Do not click on any links or download attachments. Immediately report it to your IT Team for further investigation and action. If you believe you have clicked on a phishing link, or provided sensitive information, disconnect from the computer network and inform your IT Team to minimize the damage.

Phishing Prevention Best Practices

Training and awareness- Regularly train staff on how to recognize and respond to phishing attempts. Conduct simulated phishing exercises to reinforce awareness.

Email filtering and security software- implement robust email filtering solutions to detect and block phishing emails from reaching your staff inbox.

Multi - Factor Authentication- to add an extra layer of security, making it harder for attackers to gain access even if credentials are compromised.

10 steps to ensure a successful audit

The annual external audit process can be a daunting time for many organizations. However, there are some key steps that can be taken to minimize the jitters and ensure a smooth and efficient audit:

Plan Ahead - Devote additional time both prior to and during the year end close to adequately prepare for the audit. To stay ahead of the curve, consider treating audit preparation as a year long process. Preparing monthly (or quarterly) schedules and reconciliations, reduces the the time it takes to prepare for the audit at year end. Maintaining an open line of communication with the independent auditors throughout the year , especially on new or unusual transactions, minimizes surprises and allows your organization to make appropriate plans or necessary changes.

Stay up-to-date on new Accounting Standards- You will need to keep abreast of new accounting pronouncements that may impact you organization, as this will directly impact the audit. You may need to track or manage data in a different way, in order to implement the new accounting standards or tax laws. Additionally, you will need to assess whether accounting personnel require additional training to implement the new requirements. The Financial Accounting Standards Board’s website(fasb.org) will provide all the details needed to implement a new accounting standard. The IRS website(irs.gov) will provide relevant details on implementing new tax laws.

Assess any changes in activities- Were there any significant changes in internal control systems or organizational structure? Were there any major software changes? In the case of nonprofit organizations, were there any new programs started or grants received? Such changes may trigger auditing , accounting and reporting changes, that needs to be communicated to the auditors during the planning process.

Learn from the past- Determine whether there were any prior year audit adjustments, internal control recommendations or other issues encountered during prior audits. Ensure that any similar matters in the current year are addressed prior to the commencement of the audit.

Develop timeline and assign responsibility- Review the list of workpapers and schedules requested by the auditors, making sure to obtain clarification of requested information when necessary. Assign each item from the list to a responsible person and include a due date. Tackle the most complex or time consuming requests first. The draft of the financial statements, schedules, work papers and other items requested by the auditor should be available on or before the first day of the audit fieldwork.

Be organized- Create a repository of audit schedules that can be accessed in future years by the appropriate personnel. Consider creating subfolders for significant transaction cycles or categories, such as cash, revenue and receivables, expenses and payables, investments , fixed assets , debt etc., to make it easier to manage and retrieve schedules. Schedules containing sensitive information such as payroll, may need to be password protected or maintained in an appropriately restricted network location.

Get clarification/ ask questions- If an audit request is unclear, ask for clarification prior to the start of the fieldwork to avoid potential delays and additional audit fees. Also, ask questions of relevant persons within the organization to obtain information necessary to prepare required financial statement disclosure notes. For eg. significant accounting estimates, pending litigation, related party transactions, commitments and contingencies.

Perform a self- review- Once all journal entries have been made, review schedules to ensure amounts agree or reconcile to the trial balance. Review the financial statements for overall reasonableness. Refer to a disclosure checklist to ensure all required disclosure notes have been included. Ensure that you have reasonable explanations for material variances from prior year and the current year budget numbers.

Be available during fieldwork- Avoid key personnel scheduling time off during the audit. Also, consider rescheduling or postponing non-critical meetings for accounting and finance staff heavily involved with the audit. Schedule brief status meetings , or obtain an open items listing from the auditors at regular, logical intervals during the engagement to track progress.

Finish strong- Maintain communication with the auditors during the time between fieldwork and issuance of the audit report. Schedule an exit meeting with the auditors to address any issues or open items that could delay issuance of the audit report. If there are open items at the end of the fieldwork, establish a timeline for addressing these timely.

PREPARING FOR YOUR ORGANIZATION’S SINGLE AUDIT

If your organization is the recipient of $750,000 or more of federal financial assistance within the fiscal year, you are likely subject to a single audit to comply with the Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards, collectively known as the Uniform Guidance.

Being well prepared for the single audit can help the process be more efficient. It’s a great idea to outsource the audit preparation/readiness responsibilities to a firm such as W.A. Anderson CPA. This will ensure that the audit process is stress free and efficient. In the event that your organization decides to undertake the responsibility of preparing for the audit, below are some valuable best practices that can minimize your headaches and put your organization on the road to success:

Offer targeted training to your staff. It is very important that all staff members are properly trained in their areas of responsibility. One key area to train staff in is identifying allowable costs under the grant agreement. This helps to reduce the risk of errors and non compliance with the grant agreement.

Get started on the right foot. The organization should ensure that appropriate internal controls over the relevant compliance requirements are in place. For example, there should be separation of duties/responsibilities between completing grant applications, approving applications and revisions, entering the budgets and approving expenditures to ensure compliance.

Identify and address problem areas in advance. The staff should spend significant time reviewing those areas that have been a source of problems and non compliance in the past, to prevent issues from reoccurring.

Keep up to date on all of the latest guidance and developments. The AICPA’s Governmental Audit Quality Center (GAQC) provides numerous free tools related to the Uniform Guidance to auditees in its Auditee Resource Center. These single audit tools include articles, web events, practice aids and useful links. With the massive outlay of government spending in the wake of the Covid-19 pandemic, there have been numerous changes and developments over the past year. Auditee organizations need to be aware of the changes impacting them and ensure that they are properly accounted for.

Business Risk Management- More critical than ever

The most common reason for business failure is related to poor risk management- failing to see and proactively respond to the signals of disruption right in front of them. Blackberry, Blockbuster and Kodak all come to mind. While no one could have predicted the nature, severity and global reach of the coronavirus , it’s clear that organizations should include such risk scenarios in future strategic planning discussions. To be successful in business, it is not enough to do what you do well, but you have to also be on the look out for potentially disruptive changes and put plans in place to mitigate potential negative impact.

Business risk is defined as any threat or hazard which prevents or disrupts an organization’s ability to achieve its strategic objectives. Risks may come from both external and internal vulnerabilities. One of the upsides is that once risk is identified, it can almost always be mitigated. Proactive organizations that are strategic about risk management can limit their organization’s exposure to a variety of risks.

Risk assessment is a process to identify and evaluate threats and hazards that could potentially harm a business. It involves considering the types of threats that exist, the assets at risk from the threats, and the potential negative impacts. Companies that define and evaluate the potential disasters and emergencies that they might encounter will have situational awareness at the most hazardous and critical times..

Once the organization has identified and evaluated its critical risks, a decision will need to be made whether to accept the risk and do nothing, avoid the risk entirely or take steps to mitigate the damage.

Risk assessment and analysis is not a one time event. Once the assessment and analysis has been completed, it should be updated at a minimum, once a year. Monitor your organization, customers, vendors and the external environment for changes that may create a new risk or change the ranking of an existing threat.

To ensure this process gets the full attention it needs, It is a good idea for organizations to designate a Chief Risk Office(CRO) . This responsibility may be assigned to a full time employee or be outsourced to a firm such as W.A. Anderson CPA if the technical resources are not available internally.

Smart organizations will invest into identifying and evaluating risks that could damage or close them down entirely ( from environmental risks to reputational risks) and develop strategies to limit their exposure and protect their hard-earned success.

STRONG POLICIES MAKE FOR EFFECTIVE NOT-FOR-PROFIT BOARDS

Between implementing new accounting standards, keeping up with regulatory changes, and meeting fundraising and program delivery goals, many not-for profits (NFPs) are stretched to their limits. So when it comes to creating or updating policies, it’s easy to push those tasks to the bottom of the list. However, having strong policies in place can protect your NFP from liability, help your organization adopt consistent and clear actions, and help with more efficient usage of limited resources. Sound policies can also help the governing board provide more effective oversight.

The following steps can help your NFP get the ball rolling when it comes to creating or updating policies:

Perform an inventory of the policies that are currently in place: This may require some digging if you don’t have a central repository for your organization’s policies. It may also include reviewing past board meeting minutes. As you identify the policies, create an index that lists all of them in one place. Include the date the board originally approved the policy and any subsequent dates they were reviewed and/or updated. The index can help with identification of the policies that have not been reviewed recently and finalize those that were never approved by the board.

Consider what policies should be in place and what they should include: Once the policies the organization has in place have been identified, management should consider what might be missing. Policies that a NFP organization may wish to consider having in place include:

- Designation of Funds Policy

- Delegation of Authority Policy

- Conflict of Interest Policy

- Telecommuting Policy

- Document Retention Policy

- Gift Acceptance Policy

- Information Security Policy

- Investment Policy

- Social Media Policy

- Whistleblower Policy

- Ethics Policy

- Travel Policy

Create a process for updating policies: Once your NFP has a comprehensive list of policies, it’s important to plan for periodic reviews. The frequency and time frame for review may be different for each policy. For instance, some organizations review their investment policy annually, and review other policies every three years. Establishing a policy review schedule will help to ensure that policies reflect the organization’s core values, mission and vision and are being adhered to by staff. In addition, consider establishing a consistent practice of having the board and/or board committees review and approve policies.

Establish a means of effectively communicating policies: For board members to comply with organizational policies, they need to be provided with the policies. Board members should not be placed in a position where they need to ask for them. They also need to understand them. It’s not enough to distribute the policies to the board members and ask them to sign a statement saying that they have reviewed and understand them. Formal training on the policies is necessary for board members to fully understand the need for the policies and the ramifications of not following them. The organization should consider offering comprehensive training on policies as part of the board orientation, augmented by an abbreviated policy training at each board meeting.

Ensure that policies are consistently enforced: The quickest way for policies to lose their effectiveness is to enforce them inconsistently or not at all. It is therefore important to make sure that management and the board take consistent action. Like the board, organizational staff need to understand the policies in order to comply with them. Formal policy training for staff is recommended during new hire orientation, augmented by abbreviated policy training during staff meetings.

SBA STOPS ACCEPTING NEW PPP APPLICATIONS AS FUNDS RUN OUT

On Tuesday, May 4th, the US Small Business Administration (SBA) informed lenders that the Paycheck Protection Program (PPP) was out of money and that the only remaining funds available for new applications are $8 billion set aside for community financial institutions (CFIs), which typically work with businesses in underserved communities. The agency has also set aside $6 billion for PPP applications still in review status or needing more information due to error codes.

In late March of this year, Congress extended the PPP applications deadline to May 31, in part to give the SBA and lenders time to resolve error codes that were holding up nearly 200,000 applications in the SBA’s PPP platform. The error codes were due to validation checks implemented by the SBA to prevent fraudulent applications from being funded.

The PPP Extension Act of 2021 did not include any additional funding over and above the $292 billion that was approved for the current round of the PPP .

FRAUD RISK & THE COVID-19 PANDEMIC

Research has shown that several areas of fraud risk have increased in the wake of the COVID-19 pandemic. Business Managers should know what types of fraud pose the greatest threat to the organization and develop appropriate internal controls to address these threats. If the company has recently updated its fraud risk assessment, use the results to guide your decision making. If the company has not updated its fraud risk assessment or has never performed one, this would be a good time to do so.

Fraud losses can be significant, and at times of financial stress, losses need to be kept to an absolute minimum. An investment in proper controls could save a lot more down the line.

Below are two potential fraud risk areas along with advice on controls that can be implemented to address those risks:

VENDOR FRAUD RISK

Purchasing departments might be inclined to skip some of the regular vendor checks in situations where a regular vendor cannot deliver on time and a substitute supplier is needed immediately.. In these high time and delivery situations, there may be a temptation to shorten the usual vendor screening process by cutting out some critical controls. Fraudulent vendors may approach the purchasing department requesting prepayments in advance of delivery of the goods or services, and then disappear without providing the agreed upon goods and services. Also, employees working in the purchasing department under financial stress may become susceptible to bribery.

Companies should strengthen the controls relating to the screening of new vendors. Organizations should increase scrutiny of vendors requesting significant prepayments ahead of providing any service or delivery of goods. Particular attention should be paid to new vendors without significant business relationships. and conduct open source research to ensure that the vendor is not a known fraudster.

INTERNAL FRAUD RISKS

In difficult economic times, management may decide to cut spending on its hotline or other controls to detect fraud. An effective reporting mechanism is one of the best anti-fraud measures a company may have. Tips are the most common way that fraud is detected.. Management should avoid the temptation to cut spending in these much needed areas. To get the most out of a hotline, revisit the company’s anti-fraud training for all levels of staff.

The COVID-19 pandemic has increased the incentive and opportunity for fraud in many areas of business. Proper internal controls need to be at the forefront of combatting this.

SBA ANNOUNCES OPENING OF $28.6 BILLION RESTAURANT REVITALIZATION FUND

On April 27, 2021, the U.S. Small Business Administration (SBA) announced that it will begin registrations on Friday, April 30, 2021 and open applications on Monday, May 3, 2021 for the Restaurant Revitalization Fund.

Established under the American Rescue Plan , and signed into law by President Joe Biden on March 11, 2021, the Restaurant Revitalization Fund provides a total of $28.6 billion in direct relief funds to restaurants and other hard-hit food establishments that have experienced economic distress and significant operational losses due to the COVID-19 pandemic. This program will provide restaurants with funding equal to their pandemic-related revenue loss up to $10 million per business and no more than $5 million per physical location. Funds must be used for allowable expenses by March 11, 2023.

“ Restaurants are the core of our neighborhoods and propel economic activity on main streets across the nation. They are among the businesses that have been hardest hit and need support to survive this pandemic. We want restaurants to know that help is here” said SBA Administrator Guzman.

In preparation, the SBA recommends qualifying applicants familiarize themselves with the application process in advance to ensure a smooth and efficient application experience.

For the first 21 days that the program is open, the SBA will prioritize funding applications from businesses owned and controlled by women, veterans, socially and economically disadvantaged individuals.